Materiality and KPIs

Medium-term Management Plan and Materiality

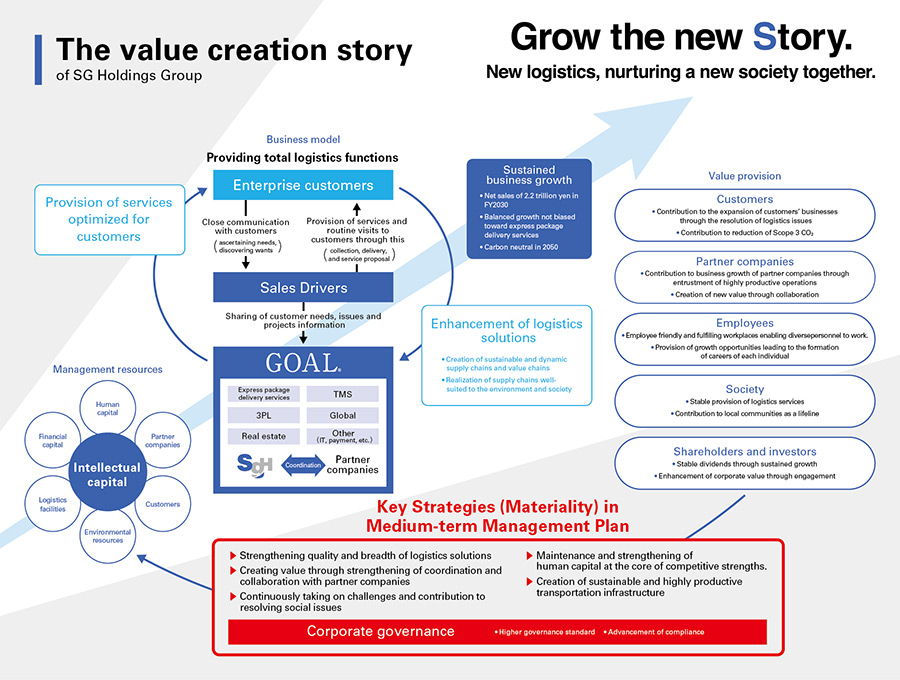

Since it was founded in 1957, the SG Holdings Group has constantly considered what it can do for customers, and has had the corporate philosophy of “Trust, Create, Challenge” with the “hikyaku no kokoro” (the spirit of Edo-era express messengers) to do its best in its heart. In addition, using the Material CSR Issues, etc. established in FY2017 as a guideline, in order to meet the expectations of stakeholders, we have worked to resolve a variety of social issues through business activities with the aim of creating new value.

Meanwhile, responses to social issues such as addressing climate change are becoming required more in international society and being shared with companies, and the management environment inside and outside the company has changed significantly such as the SG Holdings Group presenting the long-term vision of “Grow the new Story: New logistics, nurturing a new society together.” aimed at 2030.

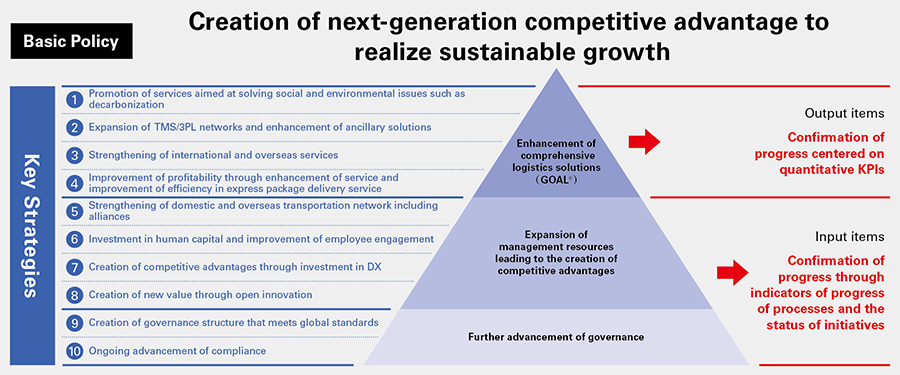

In this context, to realize further enhancement of the Group’s medium- to long-term corporate value, in FY2023, we reviewed the Material CSR Issues, redefine the ten key strategies established in the Mid-term Management Plan “SGH Story 2024” as “Materiality” made up of important management issues including ESG. Going forward, we will continue to promote the integration of sustainability and management planning.

Identification process

Identify Materiality through the following process

- Organize medium- to long-term business opportunities and risks in the Group through analysis of the internal and external environment

- Identify Group management issues in light of 1, and extract important items with a high priority

Set ten key strategies in the Medium-term Management Plan through discussion in Group Management Strategy Meetings and the Budget Committee - Discuss the re-establishment of Materiality in the Materiality Subcommittee that is a subordinate organization of the Sustainability Committee

Redefine the ten key strategies in the Medium-term Management Plan set in 2 as Materiality

* KPIs established for each Materiality are monitored once a year and the results are disclosed. The content of Materiality is also reviewed as needed.

Reference: Medium- to Long-Term Business Opportunities and Risks(790KB)

Positioning of Materiality in the value creation story

Overview of Materiality

Materiality and KPIs

| Large category | Subcategory | Reasons for selection, purpose | Major initiatives | KPIs | Progress in FY2023 |

|---|---|---|---|---|---|

| Enhancement of comprehensive logistics solutions Enhancement of comprehensive logistics solutions (GOAL®) | (1) Promotion of services aimed at solving social and environmental issues such as decarbonization | The Company recognizes that it is increasingly required to respond to various social issues, such as climate change, increasingly severe disasters, and the declining birthrate and aging population. Through the logistics solutions provided by the Group, we aim to reduce the burden on society and the environment by building a supply chain that is more sustainable and environmentally friendly for our customers. | Reduction of GHG emissions of the Company and customers (senders) | Reduction of Scope 1+2 emissions (vs. FY2013) * FY2024 target: 15% reduction |

- Scope 1+2 emissions reduced by 19.6% vs. FY2013 - Reduced by 7.1% year on year due to expansion of renewable energy implementation rate |

| Percentage of renewable energy in power usage * FY2030 target: 40% |

- 47.7% renewable energy percentage (+19.9 points year on year) - The introduction plan is moving ahead of schedule, and the target will be achieved during FY2023 |

||||

| Percentage of environmentally friendly vehicles (Total of EV, HV, CNG and clean diesel) * FY2030 target: 98% |

- 77% environmentally friendly vehicles (+13 points year on year) | ||||

| Consideration of new services and businesses aimed at the resolution of social and environmental issues | Promotion of initiatives aimed at the creation and expansion of new services and businesses | - Started delivery service using next-generation biodiesel with I8 - Expanded use of Hikyaku JR Container Transportation Service and home appliance recycling service |

|||

| (2) Expansion of TMS/3PL networks and enhancement of ancillary solutions | Customers are demanding more advanced logistics solutions due to a declining workforce, evolving technology, and the diversification of their services. By strengthening functions and proposal capabilities in “areas other than express package delivery services,” we will expand our proposal areas and services to the entire supply chain of our customers. | - Expansion of TMS projects - Increased TMS usage rate by existing customers |

TMS sales * FY2024 target: 120 billion yen |

- TMS sales: 113 billion yen (94.4% year on year) - Decreased from the previous fiscal year due to the absence of projects related to COVID-19, etc. (increased year on year when excluding special factors related to COVID-19) |

|

| (3) Strengthening of international and overseas services | The Company will respond to the expansion of international cargo volume against the backdrop of medium- to long-term growth of the global economy by strengthening its global and overseas services, including cargo to and from Japan. We will contribute to the expansion of our customers' international business and increase the Group’s volume of goods in the Last One Mile. | - Expansion of share of existing customers - New lanes, expansion of industries |

Expolanka operating revenues * FY2024 target: 136 billion yen |

- Expolanka operating revenues: 113.8 billion yen (54.9% year on year) - Ocean and air cargo volumes declined due to the slowdown of the global economy, and freight rates remained at the same level - Expanded sales of logistics services by strengthening customs clearance and forwarding functions in North America through M&A |

|

| (4) Improvement of profitability through enhancement of service and improvement of efficiency in express package delivery service | In the express package delivery services business, which is an important business base for the Group, we will maintain our business base and sustainable business growth through improvement of service and profitability by promoting investments to increase capacity and improve operational efficiency in anticipation of market growth. | - Development of new services, strengthening of services peripheral to express package delivery services - Expansion of sales in new areas |

Number of packages handled * FY2024 target: 1.38 billion |

- Number of packages handled: 1.37 billion (97.4% year on year) - Decreased due to weakening of household consumer spending caused by soaring domestic prices, etc. |

|

| Initiatives to receive appropriate freight tariffs | Average unit price * FY2024 target: 662 yen |

- Average unit price: 648 yen (+5 yen year on year) - Implemented ongoing initiatives to receive appropriate freight tariffs |

|||

| Improvement of efficiency of express package delivery services | Operating margin of Delivery Business * FY2024 target: 7.7% (Operating margin is expected to decrease from the previous year due to accumulation of expenses due to addressing the 2024 problem including partner companies) |

- Operating margin of Delivery Business: 7.9% (-1.6 points year on year) - Although the profit margin declined from the previous year due to a decrease in the number of packages handled, the target level was achieved through cost control measures such as a review of vehicle allocation (7.8% target in FY2023) - Opened Sagawa Express official LINE account, contributing to the improvement of absence redelivery |

|||

| Expansion of management resources leading to competitive advantages | (5) Strengthening of domestic and overseas transportation network including alliances | In an environment of a shrinking workforce and aging drivers, we will maintain and expand our domestic transportation and delivery network by strengthening alliances with diverse partners. Overseas, we plan to expand revenues by leveraging alliances with leading local partners. | [Japan] Strengthening of relationships with partner companies and expansion of support system |

- Expansion of SAGAWA Partner Program - Holding meetings to promote appropriate transactions |

- Expanded SAGAWA Partner Program targets and enhanced communication through additional functions on the dedicated website - From the end of FY2022, we regularly held Appropriate Transaction Promotion Meetings, confirmed requests from partner companies (cooperating companies), and set up a forum for discussions |

| [Overseas] Expansion of alliance partners associated with sales strategy |

Expansion of alliance partners | - We expanded our network by linking Expolanka with two North American logistics companies acquired in FY2022 | |||

| (6) Investment in human capital and improvement of employee engagement | In order to expand businesses other than express package delivery services (TMS, 3PL, global, etc.), which are the growth drivers in our SGH Vision 2030, it is necessary to acquire and develop solution personnel such as global and DX personnel. We will expand the human resource base to “create a competitive advantage for the next generation” by fostering a corporate culture that allows for new challenges. | - Development of management personnel and personnel able to propose solutions - Realization of diverse work styles, flexible promotion of personnel |

- Implementation of training, etc. aimed at the development of management personnel and solution personnel - Promotion of work style reform measures |

- Implemented management development program, Women’s Career Support Training, next-generation leader training, etc. - Ongoing implementation of internal committees, seminars, etc. to promote DE&I |

|

| - Periodic monitoring of employee engagement indicators - Planning and promotion of initiatives based on monitoring results |

- Affirmative response rate for questions regarding “employee engagement" * FY2024 target: 57% - Affirmative response rate for questions regarding “creating an environment that makes good use of employees” * FY2024 target: 55% |

- “Employee engagement”: 56% (-1 point year on year) - “Creating an environment that makes good use of employees”: 54% (-1 point year on year) |

|||

| (7) Creation of competitive advantages through investment in DX | In addition to a shrinking workforce and evolving technology, express package delivery services are likely to face a different competitive environment than in the past against the backdrop of factors such as the diversification of customer services. By combining technology with the Group’s resources, we will realize DX and expand services that can solve various issues faced by society and our customers. | - Promotion of measures through three aspects (strengthening of services, improvement of efficiency of operations, evolution of digital infrastructure) - Development of personnel handling DX planning |

- Promotion of services and measures through DX strategy - Promotion of DX planning personnel development activities |

- Launched a joint demonstration test of an AI-equipped cargo loading robot with Sumitomo Corporation and Dexterity - Conducted basic training and planning workshops to develop DX personnel |

|

| (8) Creation of new value through open innovation | We will create new value by crossing our resources with the superior, proprietary services possessed by startups and companies in other industries, without being limited by the Group’s internal knowledge and values. | Hosting accelerator program and strengthening of systems aimed at the creation of new businesses | Promotion of activities aimed at the creation of new businesses and services | - Nine partner companies presented ten co-creation ideas in the accelerator program | |

| Enhancement of Governance | (9) Creation of governance structure that meets global standards (10) Ongoing advancement of compliance |

As a publicly listed corporate group, all Group companies, both domestic and international, will strive to enhance their governance and compliance, the fundamental foundation for achieving transparency and credibility of their activities to their stakeholders. | - Strengthening of international legal functions, strengthening of governance of overseas subsidiaries - Establishment of systems and promotion of education aimed at strengthening of preventative legal work and compliance |

Strengthening of governance meeting global standards, promotion of initiatives aimed at advancement of compliance | - Continued activities to strengthen internal control systems at overseas Group companies - Ongoing implementation of security education, harassment education, etc. |

Management structure

We will utilize “Group Management Strategy Meetings” to confirm the progress of Materiality KPIs with the responsible departments in SG Holdings and Group companies, and analyze the causes and consider action to take if there is any deviation in the level of achievement. KPIs are monitored and results are disclosed once a year, and if any changes to the Group’s policies or measures occur or are expected due to factors such as changes in the internal or external environment, we will consider these including resetting Materiality content, targets and KPIs. Furthermore, the Budget Committee will consider measures and budgets for the next fiscal year based on progress of Materiality KPIs, and continue to promote initiatives for Materiality.

In addition, the risk aspects of “strengthening of domestic and overseas transportation network including alliances,” “investment in human capital and improvement of employee engagement” and “creation of governance structure that meets global standards” included in Materiality have been identified as the Group’s strategic risks along with “adapting to and mitigating climate change.” We will consider and discuss measures for controlling the above strategic risks through the Group Risk Management Meetings that are the Group’s risk management organs, and reflect these in management planning.