Returns to Shareholders

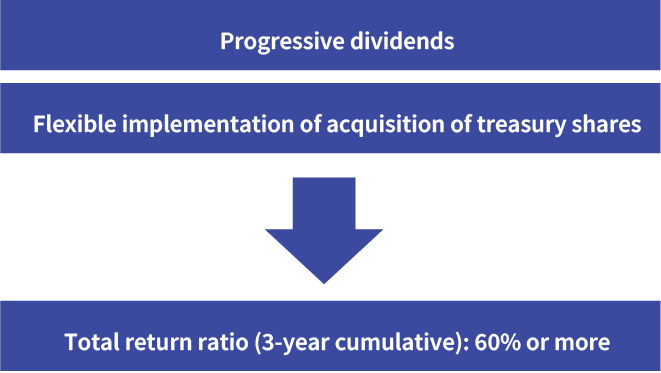

Shareholder Return Plan (SGH Story 2027 Policy)

*Approach to the acquisition of treasury shares

We will consider acquiring treasury shares at the appropriate time while communicating with our business partners in order to eliminate cross-shareholdings

We expect to acquire about 60.0 billion yen worth of treasury shares over the next three years through purchases on the open market

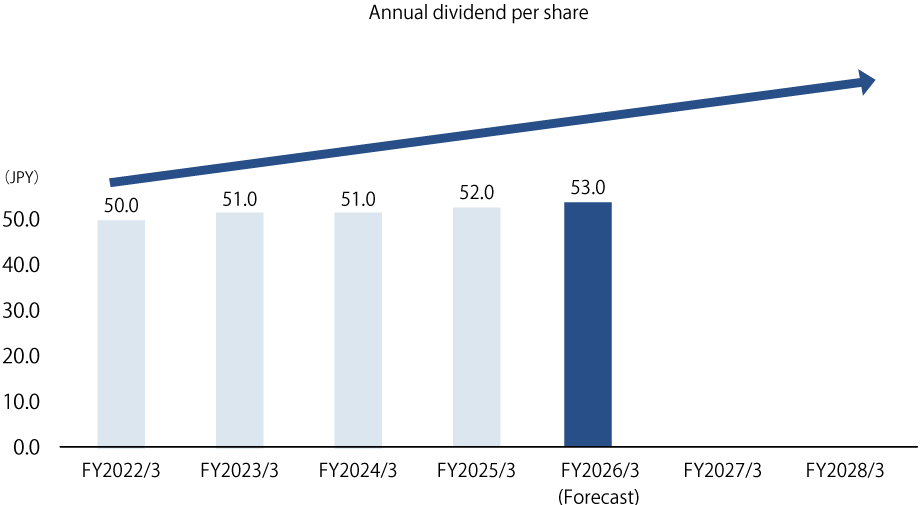

Status of Dividends

Annual dividend per share were 51 yen in the year ended March 31, 2024. The dividend forecast for the year ending March 31, 2025 is 52 yen per share.(As of May 9, 2025)

| Dividend per share | Remarks | |||

|---|---|---|---|---|

| Interim | Year-end | Annual | ||

| FY2026/3 forecast |

26.00 yen | 27.00 yen | 53.00 yen | |

| FY2025/3 | 26.00 yen | 26.00 yen | 52.00 yen | |

| FY2024/3 | 26.00 yen | 25.00 yen | 51.00 yen | |

| FY2023/3 | 25.00 yen | 26.00 yen | 51.00 yen | |

| FY2022/3 | 20.00 yen | 30.00 yen | 50.00 yen | |

Purchase of Treasury Shares

| Period of acquisition | Total number of shares acquired | Total value of the acquisition of shares |

|---|---|---|

| May. 1, 2023 - Sep. 22, 2023 | 4,769,200 shares | 9.99 billion yen |

| Oct. 3, 2022 - Mar. 24, 2023 | 5,036,600 shares | 10 billion yen |

Cancellation of Treasury Shares

The Company does not have any plans to cancel treasury shares at present.

Shareholder Special Benefit Plans

The Company does not have any plans to implement shareholder special benefit plans at present.