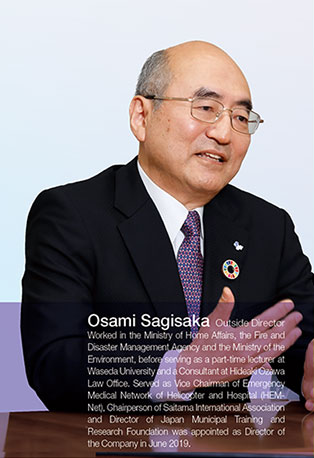

Message from the Outside Directors

We will build relationships of trust through dialogue with capital markets and aim for transformation to improve corporate value

Click here for past messages from the three Outside Directors.

Review of the previous Mid-Term Management Plan “SGH Story 2024” and discussion on the formulation of the Mid-Term Management Plan “SGH Story 2027”

AkiyamaI think the business environment during the previous Mid-Term Management Plan was extremely tough. With an eye to the future of the industry, the Group has continued to collect appropriate freight tarrifs and made investments to maintain its logistics infrastructure. However, as competition in the express package delivery industry intensified, this ultimately resulted in a reduction in the number of packages in the Delivery Business. Given that we were formulating our Mid-Term Management Plan under such an environment, I first raised the question of what kind of company the Group will strive to become in the future. This is because I thought the management team’s view on “what kind of position they wanted the Company to carve out in the industry” was of utmost importance. Various ideas were put forward in response to this, such as that express package delivery is extremely important, but we should focus on overseas markets in areas related to these operations, or that we should expand our service areas in Japan. After extensive discussions on each of these ideas, we finalized the direction of the current Mid-Term Management Plan.

SagisakaDuring the previous Mid-Term Management Plan, our business performance fluctuated significantly due to the impact of COVID-19 and other factors. As global logistics was particularly impacted, we took this into consideration, and recommended that it would be better to show the performance of global logistics separately. We believe that presenting the Global Logistics Business as an independent segment following the change in segments is a major step forward.

TakaokaThe current Mid-Term Management Plan began to take shape in June, several months earlier than the previous plan, and Outside Directors also participated in the initial discussions alongside inside Directors. As Mr. Akiyama mentioned, we started by confirming our overarching strategy and direction, and then we looked at recent trends in e-commerce platforms, social conditions, and the competitive landscape, particularly in the Delivery Business in Japan, before holding extensive discussions on where we should focus our efforts. Ultimately, with a view toward the full-scale development and expansion of the Global Logistics Business, we Outside Directors offered recommendations on various points, including information disclosure, with a focus on cash allocation and business portfolio management that incorporates a return on capital perspective. Furthermore, this Mid-Term Management Plan focuses on disclosing quantitative targets, and clarifies operating revenue, operating income, ROE, ROIC, and other targets for each segment as management targets for FY2030. In particular, the disclosure of ROIC by segment was actively discussed not only at Board of Directors meetings but also at weekly officer meetings attended by all Directors. Some people expressed the view that disclosing the profitability, growth potential and future positioning of each segment to the public could affect employee morale, as employees may be concerned that the segment they belong to is not a focus area, for example. Ultimately, we decided to disclose the information so that it would lead to a sense of urgency among employees that if hurdle rates were not exceeded within the specified period, their business would be subject to liquidation, motivating them to work even harder.

Discussion regarding the M&As for Meito Transportation, Hutech norin, and Morrison

SagisakaAs the Group aims to become a comprehensive logistics company offering Total Logistics, we believe it is essential to continuously explore growth investments that will bolster areas where our current capabilities are still limited. Amid these circumstances, Meito Transportation and Hutech norin have strengths in the upstream to midstream supply chain and BtoB low-temperature logistics areas, which the Group did not have the functions for. By combining these strengths with the Group’s last mile low-temperature logistics functions, we will be able to approach the entire supply chain in growth areas such as the food e-commerce market, including hometown tax payment. Morrison, a global freight forwarder that specializes in transporting semiconductors and other high-tech products, has strengths in air transportation. It has a complementary relationship with the existing Expolanka in that the two companies handle different products and specialize in different transport lanes. From this perspective, we determined that these two M&A deals will generate sufficient synergies and contribute to enhancing our corporate value over the medium- to long-term.

AkiyamaWe have long positioned the low-temperature logistics field as a growth area, but when it came to fully entering the field, we thoroughly discussed whether the investment would contribute to the sustainable growth of the Group. In the end, we decided to go ahead with the acquisition because we saw prospects to create sufficient synergies, as the BtoC express package delivery services business we currently run is an area that Meito Transportation and Hutech norin do not operate in, and the two companies are highly compatible with this business. As for Morrison, which shares the same forwarding business model as Expolanka, we see enough opportunity for collaboration on the operational front. In addition, as Mr. Sagisaka mentioned, Expolanka deals in apparel and Morrison deals in high-tech products, so they have completely different customer bases, which also makes new approaches possible. An international strategy of acquiring business opportunities overseas makes sense in order to avoid relying on the domestic market, which faces a declining population, but I think the challenge going forward will be how to utilize the know-how that Expolanka and Morrison have.

TakaokaThe purpose of the investments is as you both mentioned, and I believe they are appropriate investments for the Group. During the decision-making process, I was particularly concerned about whether both companies could really achieve meaningful synergies and whether the capital market would be satisfied with the price. In addition to Board of Directors meetings, we held numerous other meetings and repeatedly discussed business plans with the executive team before calculating the final valuation.

Discussion on the establishment of the Disaster Prevention Support Foundation and the third-party allotment of treasury shares thereto

SagisakaThe Group takes pride in being a highly public service-oriented business that supports logistics infrastructure. Based on this, we have fulfilled our social responsibilities in the past by transporting relief supplies to disaster-affected areas in the wake of disasters. We have also concluded partnership agreements with various local governments to establish a system that allows us to provide swift support in the event of a disaster. The aftermath of the Noto Peninsula Earthquake that struck in January 2024 revealed issues with existing disaster support systems, leading to calls for the establishment of a push-type assistance framework in which the government takes the initiative in delivering necessary supplies and equipment without waiting for specific requests from the affected areas. For a logistics company like ours, we believe that the establishment of the Disaster Prevention Support Foundation is not only a way of contributing to society, but also part of our initiatives to fulfill our mission as a company. I supported the establishment of the Foundation because I believe that the recognition of such activities by society will lead to the enhancement of our corporate value.

TakaokaWhile the scheme for funding the Foundation’s activities is to use dividends from SG Holdings shares allocated through third-party allotment, we discussed three points in particular: (1) enhancing corporate value over the medium - to long-term, (2) share dilution, and (3) whether voting rights should be exercised or not.

When issuing shares to the Foundation at a favorable price of 1 yen, we recommended that the number of shares to be disposed of would be the minimum necessary based on the Foundation’s business plan. To avoid share dilution, we also decided to simultaneously purchase an amount of treasury shares that exceeds the dilution rate. Naturally, this is based on the judgment that the share price is currently undervalued relative to future profit growth. Furthermore, given that the Foundation’s business activities are highly beneficial for the public, we Outside Directors also recommended that voting rights be withheld in order to ensure independence and transparency in the Foundation’s decision-making.

Of the three points, I believe that the most important is (1) enhancing corporate value over the medium- to long-term, as Mr. Sagisaka mentioned earlier. These words by the Chairperson and the President made the biggest impression on me: “Our business is possible because the government is allowing us to use public roads for free.” This was the view that, since we are using this infrastructure free of charge, it is our responsibility as a logistics infrastructure company to deliver supplies to disaster-affected areas in the event of a disaster or other emergency. I understood this to mean that our Group, by working together with the Foundation’s activities in order to continue to be infrastructure for customers and society even in times of disaster, would increase our credibility as a company, lead to future cash flow, sustainable growth, and increased corporate value.

AkiyamaAs Ms. Takaoka said, I think the crucial point is whether it will lead to the enhancement of corporate value over the medium- to long-term.

This is also related to what Mr. Sagisaka said, but personally, I have a vivid memory of delivering water and food by barge from Osaka to Port Island in Kobe at my previous company following the Great Hanshin-Awaji Earthquake. At the time, I worked at a food company, which in normal times did business thanks to consumers purchasing our products, so we felt an obligation to deliver supplies to the public in times of emergency.

There are limits to what an individual can do to provide relief during a disaster. This is exactly why I feel that there is great significance in a system that can provide organized support on a nationwide scale. As a logistics company, the Group’s initiatives will not only fulfill our social responsibility and earn the trust of our customers and society, but will also lead to new business opportunities, such as creating new solutions for national and local governments. As such, I believe that these initiatives will sufficiently contribute to enhancing our corporate value over the medium- to long-term.

Changes to the officer remuneration system and the structure of the Nomination and Remuneration Advisory Committee

SagisakaTurning to the officer remuneration system, with a view to strengthening governance, the Financial Services Agency is calling for transparent disclosure as part of a management policy centered on enhancing corporate value, which is also an issue of growing interest to investors. In this environment, we reviewed the evaluation indicators and criteria for our officer remuneration and clarified the link between return on capital and share price. We believe that this has enabled us to update our remuneration system to levels expected by the market in terms of strengthening corporate governance.

Furthermore, the Nomination and Remuneration Advisory Committee previously consisted of three members: myself, Ms. Takaoka, and Chairperson Kuriwada, who chaired the committee. I believe that the committee has functioned appropriately thus far, with Outside Directors making up the majority, and the two of us expressing our opinions from an independent standpoint. However, to further enhance independence and objectivity, we decided to appoint an Outside Director as the committee chair, and have it changed to a three-person structure consisting of Ms. Takaoka as chair and myself and President Matsumoto as committee members.

TakaokaLike Mr. Sagisaka, I also believe that the committee was functioning appropriately. However, I think that having an Outside Director serve as chair will clearly demonstrate our stance of strengthening governance from the perspective of minority shareholders.

Regarding the remuneration system, we have unveiled that base remuneration will be linked to ROE and total shareholder return (TSR). This is because we believe that it is important to reflect TSR in remuneration to align interests with shareholders, since there are cases where share price do not rise even when companies generate profit. I think that this communicates more clearly that Directors are approaching management from the same perspective as shareholders. We also reviewed our disclosure to ensure that the terms used are clear and easy to understand.

Previously, we used the terms “fixed remuneration” and “performance-linked sharebased remuneration.” Fixed remuneration actually included performance-linked elements, and even though the level of remuneration for the following year was determined in consideration of the performance of the previous year, it may have appeared that officer remuneration was not really linked to performance. To make it easier to understand, we have changed the wording from “fixed remuneration” to “base remuneration.” In fact, what made us realize that there was an issue with the wording of our disclosure was a comment from an institutional investor at a small meeting held in April 2025, who stated that the ratio of performancelinked remuneration in total officer remuneration seemed low. Going forward, we plan to continue making necessary improvements while utilizing such dialogue with investors.

AkiyamaIn reviewing our officer remuneration system, we reaffirmed the importance of using language that clearly communicates the Company’s initiatives and approach to all stakeholders. In that sense, I feel that IR will become increasingly important moving forward, and believe that building relationships of trust through IR activities, including us as Outside Directors, will also lead to the enhancement of corporate value.

TakaokaCurrently, interest rates in Japan are on the rise, and I believe that capital costs, which consist of the weighted average of the cost of debt and the cost of shareholders’ equity, will also rise accordingly. The Group is working to increase its earning power while also strictly managing capital costs. From this perspective, to reduce the cost of capital, the Group has, for the past few years, pursued growth through leveraged management, utilizing funds procured from financial institutions to make investments. Our debt ratio has been rising of late, pushed up by the large investments in Meito Transportation, Hutech norin, and Morrison. As our debt ratio rises, our debt costs could also increase due to concerns about our financial position. Therefore, we will appropriately control the cost of capital to maintain a balance, thereby steadily generating ROIC that exceeds this cost.

Also, in terms of the cost of shareholders’ equity, the beta value included in the calculation is the only factor that a company can control. In order to lower the beta value, it is crucial that we understand what investors want from the Group and minimize information asymmetry, as well as control liabilities that accompany investments. To achieve this, it is important to have dialogue with capital markets.

As I mentioned earlier, this fiscal year we also held small meetings between us three Outside Directors and institutional investors. In particular, we need to steadily demonstrate the results of large-scale M&As, such as those carried out recently, and the process of achieving these results through dialogue. I believe that communicating to the market that this is being overseen by Outside Directors will help build trust. Furthermore, in terms of share price, given that the average PER for listed companies on the Prime Market is 16 to 17 times, our PER today (at the time of this interview) is around 17 times, so we can say that our current share price is at a standard level, but I believe there is room for improvement given our past PER levels. In order to increase our share price and therefore PER, it is important to not only steadily boost earnings per share (EPS), but also to create expectations for future growth. To achieve this, we consider it necessary to have proper dialogue with the capital markets and demonstrate our investment stance and that we are steadily generating returns.

AkiyamaAlthough we have had opportunities to share our management and financial strategies up until now, as our earnings have been steadily growing, perhaps we have placed more emphasis on producing solid results. However, from last year through this year, the entire management team, including us Outside Directors, has become more determined to engage in thorough dialogue with the capital markets, and we have clearly stated in our Mid-Term Management Plan that we will strengthen our dialogue with the capital markets. If market participants perceive a company as one whose activities are unclear, this company can lose considerable trust. Therefore, I feel that we need to disclose information more openly than ever before and clearly communicate who we are as a company.

SagisakaAs Ms. Takaoka and Mr. Akiyama mentioned, after implementing such large M&As in succession, it is key that we actively communicate with the market, such as by providing detailed explanations.

Initiatives aimed at decarbonization

SagisakaWith regard to decarbonization, partly due to being headquartered in Kyoto, the Group has been particularly environmentally conscious since around 1997, when the Kyoto Protocol was adopted, and has been actively carrying out initiatives on this front. In particular, initially, the Company actively promoted the introduction of natural gas vehicles as a measure to combat air pollution, and even from an outside perspective, I think this was a very advanced and wonderful initiative.

Currently, we have established a Sustainability Committee and are steadily advancing initiatives in line with government policies while holding various discussions. The GX Promotion Act has been enacted in Japan, and the GX2040 Vision was approved by the Cabinet in February 2025. We intend to continue addressing these issues across the entire Group based on this plan. We recognize that addressing such environmental issues is not only a way of contributing to society, but also our social responsibility as a company, and an important issue in running a sustainable company.

TakaokaFor a logistics company like the Group that uses large amounts of energy, choosing which type of energy to use for transportation is a very important issue.

Currently, amid advancements with the development of electric vehicles (EVs) and fuel cell vehicles (FCVs), the Group has introduced some of these vehicles. However, concerns about fuel efficiency and costs mean that there are still challenges to their full-scale introduction. There are also various other options, such as biodiesel vehicles, and I believe that logistics companies, including ours, are at a stage where they must seriously consider which energy sources to use and to what extent, to reduce environmental impact while also achieving economic rationality.

AkiyamaThe Group was very early in adopting natural gas, but as Ms. Takaoka mentioned, other companies are ahead of us in terms of introducing EVs. In a sense, rather than jumping on the bandwagon, I think that taking a step back to carefully assess the state of development of environmentally-friendly vehicles and whether they are truly effective, is a smart move. I believe that the Company will be fine as long as it has a system in place to respond to any new technology that is developed at any time, and I feel that it already has such a system in place.

SagisakaI also believe that the Group’s logistics infrastructure exists thanks to our partner companies. If we were to switch all vehicles to EVs, it would impose a huge cost burden on our partner companies. As we are expected to carry out decarbonization initiatives, including with business partners that generate Scope 3 emissions, we need to consider collaborating with partner companies and implementing support measures.

SagisakaAs outlined in the Mid-Term Management Plan, I believe that focusing on new areas such as real commerce targeting inbound tourism and other tourism-related demand, as well as low-temperature logistics and cross-border e-commerce, will be key to steadily achieving the targets for the Delivery Business as a growth area.

In addition, having conducted two large M&A deals in FY2025/3, we need to demonstrate the synergies initially envisioned in terms of both quantitative and qualitative results in the current fiscal year. I would also like to reiterate that we must provide an in-depth explanation to the capital markets regarding our efforts to create synergies.

TakaokaI think what Mr. Sagisaka said sums it up. Through the current Mid-Term Management Plan, I feel that our mission and targets have been clarified throughout the Company. In the Delivery Business in Japan, we must strengthen cross-border e-commerce and efforts to meet demand from foreign visitors, as well as increase profitability by receiving appropriate freight tariffs. As for the Logistics Business, we are making efforts to create synergies with Meito Transportation and Hutech norin, and in the Global Logistics Business, it is essential to establish a stable revenue base by carrying out post-merger integration (PMI) for Morrison and creating synergies with the current Expolanka. I believe that by steadily implementing these growth strategies for each segment, we can expect to see results that will help us achieve our targets.

AkiyamaShort-term monitoring and execution are important, but I feel it is even more important that all employees work with a strong awareness of our vision for long-term growth, such as envisioning what this company will look like in the future.

The Group is not simply a company that offers express package delivery services, but is on the path to becoming a comprehensive logistics company that can provide total logistics services. Of course, we need to generate solid profits from the mainstay express package delivery services business, but moving forward, we will increase collaboration not just in Japan, but overseas as well. Amid such changes, I think it is extremely important for employees to further change their mindset with the conviction that they will provide services that are second to none. I hope that by steadily carrying out initiatives over the course of the year with this mindset at heart, our vision for FY2030 will become even clearer.