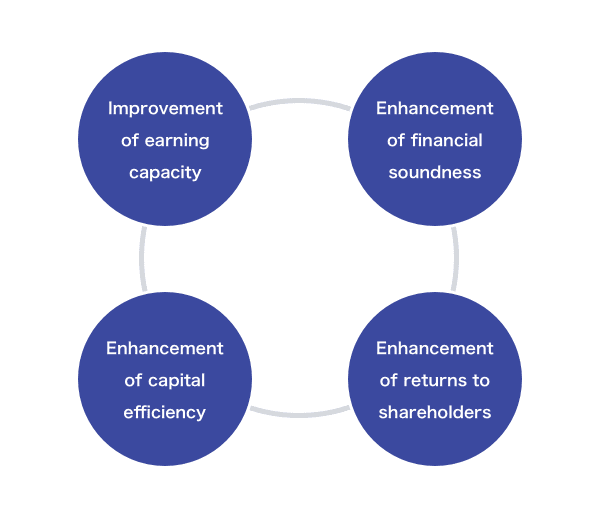

Positioning of Management Indicators in the mid-term management plan

The Group is seeking to implement investment in growth for enhancing mid- to long-term corporate value and enhance returns to shareholders while improving earning capacity of its core business and balancing a high level of financial soundness with capital efficiency, through the management strategies of the mid-term management plan.

Improvement of earning capacity

Sustained enhancement of operating revenues, operating income and operating margin

Operating margin (March 31, 2024) :6.8% (down 2.6 points year on year)

Enhancement of financial soundness

Creation of a robust financial base for supporting investment in growth for enhancing medium- to long-term corporate value

Enhancement of capital efficiency

Implementation of management conscious of maintaining and enhancing ROE by emphasizing the cost of capital, and managing the rate of return on invested capital to exceed the cost of capital in investment

ROE (March 31, 2024) :10.3% (down 13.8 points year on year)

Enhancement of returns to shareholders

Under the medium-term management plan "SGH Story 2024", the company aims to increase dividends from the previous year, targeting a consolidated dividend payout ratio of 30% or more.