Message from the Director in Charge of Finance and Corporate Planning

Excerpt from the Integrated Report 2025

My Mission

I am Koji Takagaki, and have been appointed Director in charge of Finance and Corporate Planning.

To permanently realize the Group’s vision of “continuing to be an indispensable presence (= infrastructure) for our customers and society,” I think it is important to continuously increase our corporate value and earn recognition from the capital market.

My mission is to sustainably increase our corporate value and share price, and in order to achieve this, it is important that we organically link our business strategies with our financial and capital strategies, ensuring consistency. Furthermore, it is crucial that we engage in dialogue with the market to ensure effectiveness, and we must accurately reflect the feedback we receive through dialogue in our next strategies, thereby creating a virtuous cycle that enhances the precision and effectiveness of our strategies. As the person responsible for corporate planning, finance, accounting, public relations, and IR, I feel a great sense of responsibility to carry out all of these functions. I will take advantage of this system that is conducive to creating a virtuous cycle and work quickly to improve the corporate value of the Group.

Process for Realizing Corporate Value and Share Price Improvement

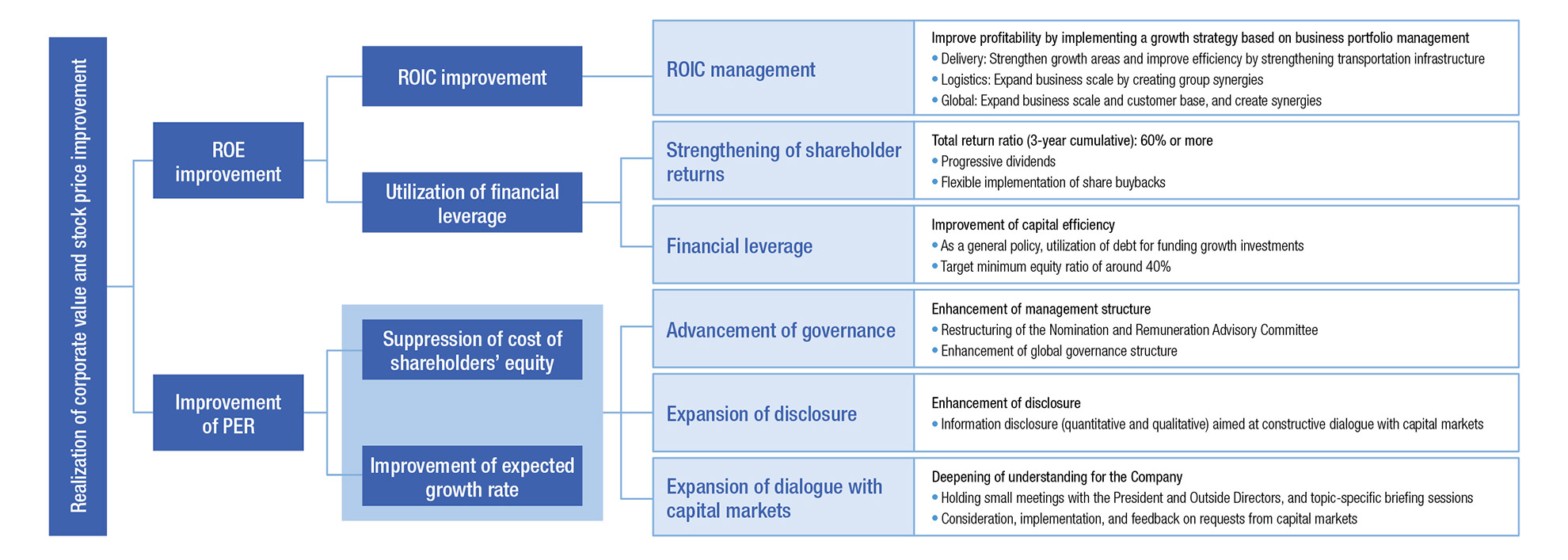

In realizing corporate value and stock price improvement, the Company will pursue initiatives based on the two pillars shown in the diagram on the right.

Logic tree for improving corporate value and stock price

The first pillar is ROE improvement. We believe our top priority is to maximize the synergies from our two large-scale M&A deals, and improve our profitability by enhancing Total Logistics, centered on the Delivery Business, as a more solid business foundation. We also believe it is important to generate sustainable profits while appropriately controlling the cash flow we obtain from these deals and use them to fund our next growth investments.

Therefore, we will strengthen our efforts to improve ROIC while improving the profitability of each segment. The second pillar is P/E ratio (PER) improvement. We will accurately grasp the needs of our shareholders, suppress risk factors, and repeat active information disclosure and dialogue so that expectations for the Group’s growth potential and future prospects can be enhanced. Through these efforts, we will be aiming to achieve sustainable improvement in our corporate value and share price.

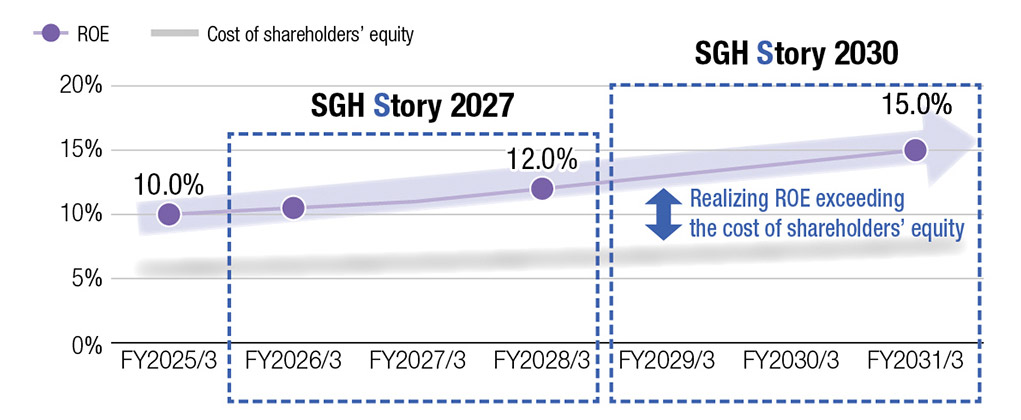

Our understanding of return on capital and ROE targets

Measures Toward Improving Profitability

Centered around the domestic express package delivery services business, the Group has expanded the areas in which it provides Total Logistics encompassing 3PL and TMS, toward realizing our vision. By solving diversifying and complex logistics challenges and creating new value in a rapidly changing social environment, we will contribute to realizing a sustainable society while aiming for sustainable growth alongside our customers’ businesses. By FY2030, in addition to responding to various customer needs, we will focus especially on advancing the expansion of our logistics operations in overseas growth markets, providing combinations of logistics solutions that span from upstream to downstream, and building a structure that can coordinate customers’ entire supply chains. Through these strategies, we aim to achieve operating revenue of 2.2 trillion yen, operating income of 140.0 billion yen, net income attributable to owners of the parent of 98.0 billion yen, and ROE of 15% in FY2030.

Our Mid-Term Management Plan “SGH Story 2027” is the second stage toward realizing “SGH Vision 2030.” Details of our strategies are described from page 36 onward, so here I will just highlight the key points.

Delivery Business

For our core service of express package delivery service, we will maximize Group synergies and achieve sustainable growth by expanding the number of packages through the capturing of growth markets and the improvement of service quality, while also continuing to focus on collecting appropriate freight tariffs and investing in maintaining, strengthening, and improving the efficiency of our transportation and delivery infrastructure.

Within express package delivery services, we have positioned three areas as especially important for growth: real commerce, cross-border e-commerce, and low-temperature logistics. In real commerce, against the backdrop of expanding tourism and leisure markets, we will deploy highly convenient delivery services targeting locations frequently visited by individual customers, such as agricultural product direct sales outlets, roadside stations, and hotels. Low-temperature logistics will be discussed in the following section.

Furthermore, for TMS, a transportation service other than express package delivery, we are tapping heightened outsourcing needs in the wake of so-called “2024 problem” and expanding services across the entire logistics market, including inhouse logistics (markets where companies conduct logistics themselves without outsourcing to specialized logistics providers).

We also are proceeding with investments toward establishing new large-scale transfer centers at each of the three regions, Kanto, Kansai, and Kyushu, which we began during the period of the previous Mid-Term Management Plan. When these transfer centers become operational, we believe they will not only provide us with the capacity to handle the gradually increasing express delivery package volumes expected over the medium- to long-term while allowing us to maintain high quality, but will also contribute to improving profitability through enhanced transportation efficiency from hub consolidation and labor-saving and efficiency improvements from cutting-edge material handling equipment.

Logistics Business

In July 2024, by making Meito Transportation and Hutech norin (below, “Meito/ Hutech”) Group companies, we acquired a low-temperature logistics infrastructure.

By combining the last mile functions that the Group possesses with the low-temperature logistics functions that Meito/Hutech handle in the upstream to midstream of the supply chain, we will build one of Japan’s leading cold chains.

To realize this strategy, the management teams of Sagawa Express, and Meito/Hutech are working closely together while pursuing initiatives toward early synergy generation. Particularly in sales, new initiatives are progressing, such as utilizing Sagawa Express’s strong sales capabilities and proposal-making abilities to make proposals that leverage Meito/Hutech’s strengths to customers facing low-temperature logistics challenges. We believe that strengthening the lowtemperature logistics area will contribute to creating synergies across the entire Group. For example, it will not only expand the revenue base of the Logistics Business but also lead to an increase in the number of express delivery packages.

In areas other than low-temperature logistics as well, we will expand business scale and improve profitability by providing high value-added services that form part of Total Logistics and through material handling investments that will contribute to efficiency improvements.

Global Logistics Business

In view of the direction of business strategies toward realizing the “SGH Vision 2030” and differences in profitability by business, we established a new “Global Logistics Business” segment from FY2026/3. Reorganizing our forwarding business and overseas 3PL business, which were previously classified under the Logistics Business, into this segment. In the Global Logistics Business, we will move ahead with the expansion of our global logistics infrastructure by expanding across industries and logistical areas. In line with this, on May 20, 2025, we acquired Morrison Express Worldwide Corporation, a global freight forwarder with strengths in air transportation of high-tech and electronic products.

Creating synergies between EFL (a general term for operating companies with forwarding functions) operating under Expolanka and Morrison will be vital for future growth. Morrison is based in Taiwan and has strengths in air transportation of high-tech and electronic products, while EFL has strengths in ocean transportation centered on apparel and daily goods. By combining both companies’ know-how and customer bases, we expect to see cost reductions by improving procurement capabilities and the acquisition of new customers. We also anticipate business growth by strengthening business foundations in Asia including Japan. For example, we can develop business in Japan and India, which are becoming bigger presences in the semiconductor industry.

Recently, we have been advancing initiatives toward early synergy creation by establishing a PMI structure and strengthening business-level coordination between Morrison and EFL.

Measures Toward Improving Capital Efficiency

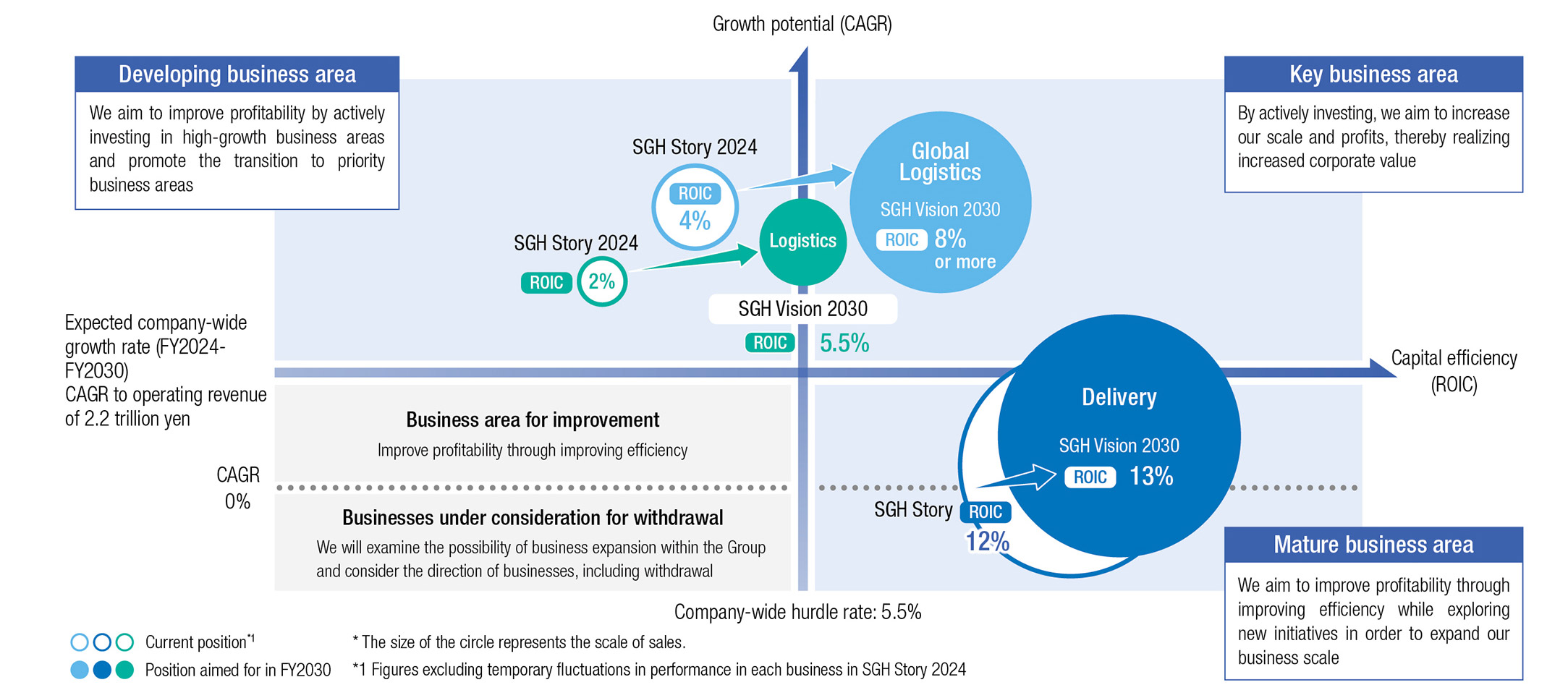

So far, I have explained the growth strategies for each business, but regarding the management of each business from the standpoint of the Group, we have formulated a business portfolio strategy for the “SGH Vision 2030” that emphasizes improving the ROIC of each business in order to increase consolidated ROE. We will set strategic directions for each business based on growth potential and return on capital, and while expanding synergies across businesses, we will maintain and improve the Group’s overall growth potential and return on capital in a balanced manner.

Business portfolio strategy

We have set the Group-wide hurdle rate at 5.5% for FY2026/3, having considered the current interest rate environment and other factors. Regarding the Delivery Business, the ROIC exceeds this hurdle rate, but the market is projected to experience only modest growth. Therefore, we are positioning it as a mature business area and will aim to improve profitability through efficiency improvements while exploring business scale expansion via new initiatives and other approaches.

Meanwhile, the Logistics Business and Global Logistics Business cannot currently generate ROIC above the hurdle rate, yet we view them as businesses with high future growth potential and are positioning them as business areas for development.

For these two segments, we will pursue revenue enhancement through aggressive investment and grow them from business areas for development to priority business areas. We will also verify each segment’s ROIC on an annual basis, and if it falls below the hurdle rate, we will discuss devising improvement measures and their implementation processes at meetings of the Investment Committee and at Board of Directors meetings. By building up such initiatives, we will steadily advance business portfolio optimization and management control to surpass the hurdle rate level for the Logistics Business and achieve ROIC of over 8% for the Global Logistics Business by FY2030.

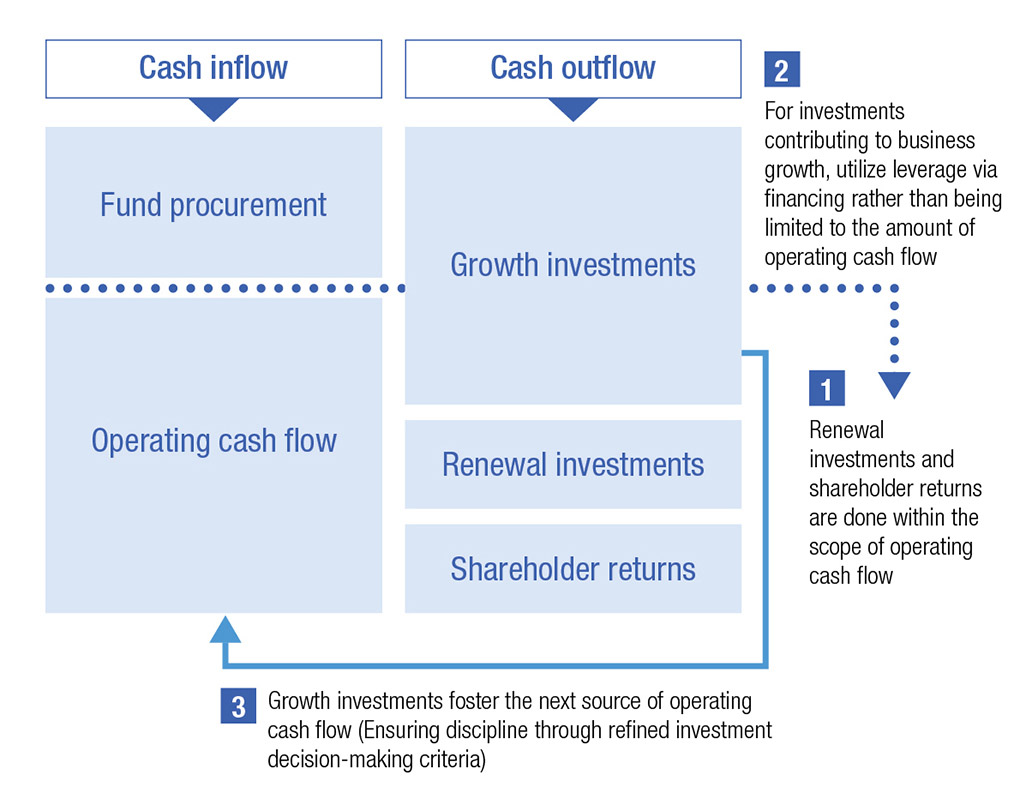

Based on this business portfolio strategy, we have redefined the allocation of free cash flow generated by businesses as our basic cash allocation policy.

Approach to cash allocation

- Use operating cash flow as the source for facility renewal investments and shareholder returns

- For investments contributing to business growth, utilize leverage via debt financing rather than being limited to the amount of operating cash flow

- Cultivate sources of future operating cash flow by executing growth investments

Regarding investment decisions, we will control invested capital and returns by refining quantitative criteria (project ROIC) for assessing whether returns that are sufficient for improving corporate value over the medium- to long-term can be secured, and by making comprehensive judgments combined with qualitative criteria such as Group strategy and needs related to business continuity. As for fund procurement, we will basically use debt for growth investments, utilize financial leverage, and suppress cost of capital increases as much as possible. However, out of consideration for financial soundness, we are currently targeting an equity ratio around 40%, and will continually monitor the balance of our capital structure.

For shareholder returns, operating cash flow will be the source. We have set the total payout ratio at 60% or higher for the three years of this Mid-Term Management Plan, and will be progressively increasing dividends. Regarding treasury share acquisition in the market, we plan to spend 60.0 billion yen or more over the three years on acquiring our own shares, and will return 45.0 billion yen to shareholders through treasury share purchases starting in May 2025. For the remaining 15.0 billion yen, we will acquire treasury shares at appropriate times, taking into account factors such as the balance of surplus funds and progress with investments.

From the perspective of balance sheet control, we will also work on reviewing the level of cash on hand and assets held.

Measures Toward Improving Expected Growth Rate

In addition to improving ROE through the initiatives described above, we believe it is important to advance our governance system, enhance disclosure, and expand dialogue with capital markets in order to improve PER. This is also included as the ninth key strategy in our Mid-Term Management Plan.

1.Enhancement of governance

We will keep working to enhance our governance system with the aim of increasing the transparency and reliability of our management. We received many valuable opinions from institutional investors at small meetings with our Outside Directors and the President held in FY2026/3.

In particular, comments regarding governance were promptly discussed internally, and specific actions were taken, including changing the chairperson of the Nomination and Remuneration Advisory Committee to an Outside Director, clarifying officer remuneration standards, and introducing return on equity (ROE) and total shareholder return (TSR) as target indicators. Furthermore, by establishing an executive stock ownership plan, we have created a system that provides both inside and outside Directors with incentives for improving business performance and stock price, and are working to improve the effectiveness of governance. In the future, we will keep working to enhance governance throughout the entire group, including improving the governance systems of the two companies that joined through M&As, and strengthen our management structure to contribute to improving corporate value.

2.Enhancement of information disclosure

To date, we have tended to provide quantitative disclosure of highly achievable items, particularly regarding our earnings forecasts and other plans for the future, while limiting ourselves to qualitative expressions for highly uncertain factors.

However, we recognize that this approach does not provide sufficient information for constructive dialogue with capital markets.

In light of the challenges we are facing, we will promote highly transparent disclosure, using quantitative information as much as possible. We believe that clarifying our targets for ROE, ROIC, and revenue and profit by segment in our Mid-Term Management Plan is a major step forward. While our efforts towards enhancing information disclosure are still in progress, we will continue to take everyone’s opinions seriously and pursue disclosure methods that will contribute to better dialogue.

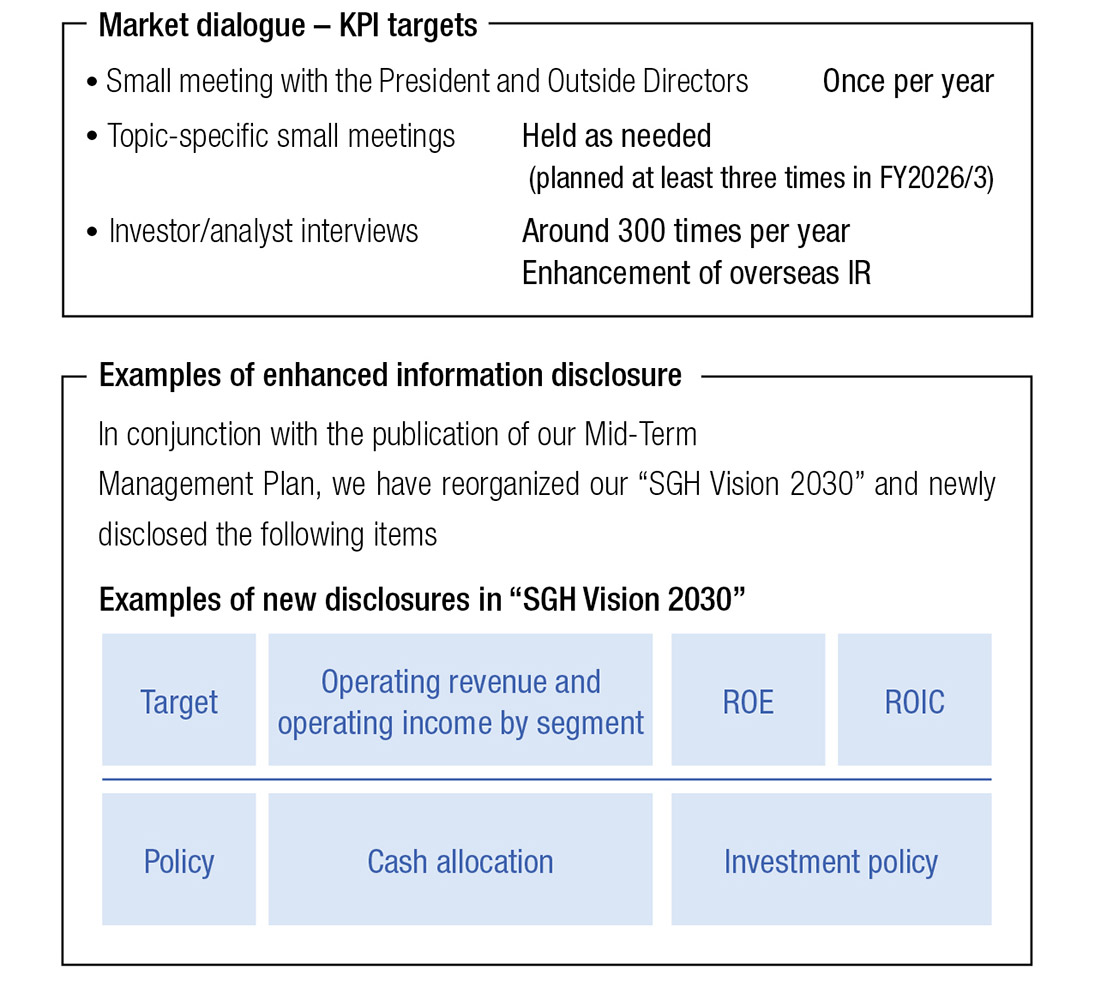

Examples of IR KPIs and enhanced information disclosure

3.Expansion of dialogue with capital markets

We advocate Total Logistics and have diversified our business, but we regret not having made sufficient efforts to gain a deeper understanding of each of our businesses. The Meito/Hutech and Morrison businesses in particular are important to the Company, and we understand that the market is paying close attention to whether these two M&A deals will succeed. In order to better understand business growth through the creation of future synergies, we would like to hold briefing sessions focused on themes such as individual businesses.

Furthermore, through small meetings or one-on-one dialogues, I have been reminded that there are still gaps between how we perceive the Group internally and how it appears from outside. One of the reasons for this is that we have not explained how we internally consider and address the opinions we receive. The structural changes to the Nomination and Remuneration Advisory Committee are one example of such efforts, but we will continue to create a virtuous cycle in which we take opinions from the capital markets seriously, consider them internally, provide feedback, and use the results to inform our next round of dialogue.

I believe that we must continue to improve the quality of our governance, disclosure, and dialogue, and will work actively and sincerely to increase everyone’s understanding and expectations of us through constructive dialogue. By continuing to create this virtuous cycle, we will achieve sustainable increase in our corporate value and share price.

Director in charge of Finance and Corporate Planning

Koji Takagaki